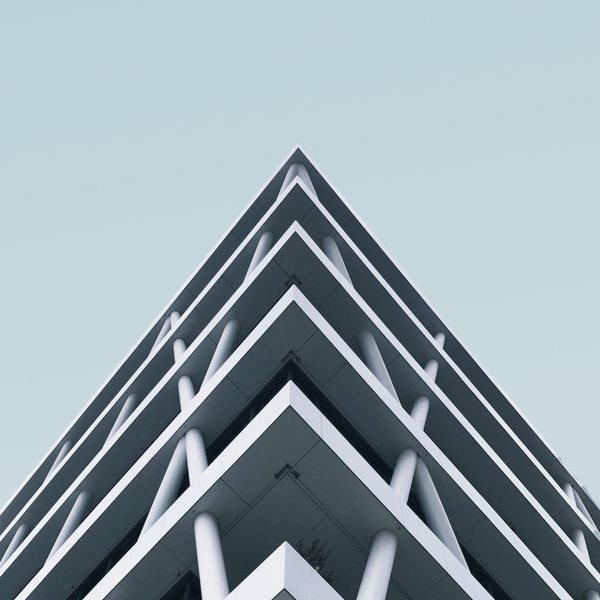

Find a home

that fits perfectly

with your lifestyle

For Sale

For Rent

Property Type

No options

Loading options...

{{ option.count }}

Price

No options

Rent Price

No options

Our Services

See How Listivo Can Help

Buy a home

Lorem ipsum dolor sit amet, consectetur adipiscing. Ut eleifend scelerisque nisi mauris

Sell a home

Lorem ipsum dolor sit amet, consectetur adipiscing. Ut eleifend scelerisque nisi mauris

Rent a home

Lorem ipsum dolor sit amet, consectetur adipiscing. Ut eleifend scelerisque nisi mauris

Why Us?

Explore Listings on Listivo

Maecenas tristique feugiat eros, quis porttitor tortor fringilla quis. Aenean porta vehicula felis, malesuada maximus justo egestas non. Duis ultrices euismod dignissim. Praesent maximus condimentum maximus.

Mauris vehicula ligula sem.

Mauris vehicula ligula sem.

27

K

Quality Searches

20

+

Neighborhoods

50

+

Houses sold

Check Out What's New

Featured Listings

Apartments

Houses

Land

Offices

Minimalist style flat

$ 1,800,000

Bedrooms: 4

Bedrooms: 4

Quick View

Add to compare

Add to favorites

296 Views

Studio apartment

$ 1,500,000

Bedrooms: 3

Bedrooms: 3

Property Size: 9,450 ft²

Quick View

Add to compare

Add to favorites

263 Views

Modern two bedroom apartment

$ 1,500

Bedrooms: 3

Bedrooms: 3

Property Size: 850 ft²

Quick View

Add to compare

Add to favorites

172 Views

Rustic style apartment

$ 2,000,000

Bedrooms: 6

Bedrooms: 6

Property Size: 5,000 ft²

Quick View

Add to compare

Add to favorites

168 Views

Spacious City Apartment

$ 350 /month

Bedrooms: 2

Bedrooms: 2

Property Size: 180 ft²

Quick View

Add to compare

Add to favorites

547 Views

Spacious Modern Apartment

$ 800,000

Bedrooms: 4

Bedrooms: 4

Property Size: 350 ft²

Quick View

Add to compare

Add to favorites

377 Views

Popular Places

Discover a Place You'll Love to Live

What Our Clients Say

Testimonials

Aenean porta vehicula felis, malesuada maximus justo egestas non ultrices euismod.

It was the first time I ever sold a property

Donec nibh nibh, tempus sit amet dignissim finibus ultricies vitae urna. Pellentesque at urna non laoreet. Aenean euismod, et laoreet luctus, justo ligula libero felis.

Emily Rees

Marketing Specialist

Thank you very much for selling our apartment

Donec nibh nibh, tempus sit amet dignissim finibus ultricies vitae urna. Pellentesque at urna non laoreet. Aenean euismod, et laoreet luctus, justo ligula libero felis.

James Smith

Office Assistant

It was the first time I ever sold a property

Donec nibh nibh, tempus sit amet dignissim finibus ultricies vitae urna. Pellentesque at urna non laoreet. Aenean euismod, et laoreet luctus, justo ligula libero felis.

Emma Miller

Project Manager

Thank you very much for selling our apartment

Donec nibh nibh, tempus sit amet dignissim finibus ultricies vitae urna. Pellentesque at urna non laoreet. Aenean euismod, et laoreet luctus, justo ligula libero felis.

Adam Jarod

Sales Manager

It was the first time I ever sold a property

Donec nibh nibh, tempus sit amet dignissim finibus ultricies vitae urna. Pellentesque at urna non laoreet. Aenean euismod, et laoreet luctus, justo ligula libero felis.

Emily Rees

Marketing Specialist

Thank you very much for selling our apartment

Donec nibh nibh, tempus sit amet dignissim finibus ultricies vitae urna. Pellentesque at urna non laoreet. Aenean euismod, et laoreet luctus, justo ligula libero felis.

James Smith

Office Assistant

Hot Topics From The Industry

The Latest News

The Most Inspiring Interior Design Of 2022

Edan

Tempor incididunt ut laboret dolore magna aliquaut enimad mini veniam quis nostrud exrciton. Lorem ipsum dolor sit amet, consectetur adipisicing elit sed eiusmod tempor incididunt labore dolore magna aliqua quis nostrud.

7 Instagram Accounts for Interior Design Enthusiasts

Edan

Tempor incididunt ut laboret dolore magna aliquaut enimad mini veniam quis nostrud exrciton. Lorem ipsum dolor sit amet, consectetur adipisicing elit sed eiusmod tempor incididunt labore dolore magna aliqua quis nostrud.

Renovating a Living Room? Experts Share Their Secrets

Edan

Tempor incididunt ut laboret dolore magna aliquaut enimad mini veniam quis nostrud exrciton. Lorem ipsum dolor sit amet, consectetur adipisicing elit sed eiusmod tempor incididunt labore dolore magna aliqua quis nostrud.

Interior Design Books for Beginners

Edan

Tempor incididunt ut laboret dolore magna aliquaut enimad mini veniam quis nostrud exrciton. Lorem ipsum dolor sit amet, consectetur adipisicing elit sed eiusmod tempor incididunt labore dolore magna aliqua quis nostrud.

Our Newsletter

Get subscribed today!

Lorem ipsum dolor sit amet, consectetur adipiscing. Ut eleifend scelerisque nisi mauris

Useful Links

Categories

Newest Listings

Minimalist style flat

$ 1,800,000

Studio apartment

$ 1,500,000

Modern two bedroom apartment

$ 1,500 /month

Rustic style apartment

$ 2,000,000

© 2022 Listivo - Listing Directory WordPress Theme. All rights reserved.